Higher yields and lower levels of competition from domestic players in comparison with Europe’s other core markets pushed Asian investors to spend 9,5% of all capital in the CEE region in 2019.

A new report by Skanska, Colliers International and global law firm Dentons has revealed that the volume of Asian capital (originated from Singapore, the Philippines, China, South Korea and Malaysia), invested directly in CEE since 2013 has reached €7.7 billion, compared to € 8.6 billion inflow of German capital. The annual joint CEE Investment Report “Thriving Metropolitan Cities” is looking at the cities, referencing their growing importance in global economy and their investment potential for foreign investors. The report also canvasses views from Asian investors on the relevance of CEE in their investment strategies.

Adrian Karczewicz, Head of Divestments at Skanska commercial development business unit in CEE: “As the biggest office developer in Europe, since few years we’ve been observing with a great interest an inflow of Asian rooted investors. They are searching for core commercial assets with long leases and strong tenants. Western Europe has all that, but CEE doesn’t stay behind. What’s crucial is that with the same quality product, our region offers more attractive yields and that’s what investors are looking for. As long as they may expect high return on investments, it doesn’t matter if it’s Lyon or Budapest – the country is a secondary issue. Our experience with Asian investors proves that either they are entering directly in Europe or like Korean investors invest in European markets through Korean Asset Management Companies and local platforms like CBRE GI in our deal in Prague. It’s worth underlining that Asian investors may have different investment approach. Yet, they all rather develop strategies towards specific cities in our region, not countries.”

Central and Eastern Europe is one of Europe’s key real estate investment destinations, with Poland having a market share in excess of 50%, the greatest product diversity and liquidity generated by investors of various origins. The ever-improving performance of the region is underpinned by a combination of the stable legal and political systems, robust economic growth and healthy leasing fundamentals, as well as a still-attractive price point compared with Western Europe.

Luke Dawson, Managing Director, Head of Capital Markets, CEE, Colliers International adds: “The region has enjoyed an unprecedented inflow of overseas capital, ranging from South Africa to Asia. Investors from Asian markets have already made purchases in Poland, the Czech Republic, Slovakia and Hungary, with other markets potentially within the scope of their interest. Typically targeting long-term income, they have emerged as major competitors to Germany-domiciled funds, which have been market-makers in the region for years” .

Key findings of the report include:

South Korean investors notably active

South Korean investors, supported largely by Korean pension funds, have become aggressive in pursuing opportunities in CEE. The two most important factors that stand behind this trend are a favourable foreign exchange situation e.g. compared with higher negative hedging costs in the US and the availability of higher yields. Only by moving up the (perceived) risk curve in CEE, as opposed to investing in more yield tapped-out markets, such as Germany, are more robust returns available. Of course as any other investor they are also searching for a rental growth.

In contrast to capital from Hong Kong, which is almost solely focused on Central London offices, South Korean investors have shown a willingness to explore a wider range of property types. In 2019, for example, € 670m has been spent in Vienna, € 544m on Prague offices, and close to € 400m on a mix of Polish office and industrial assets. Real Capital Analytics has also recorded the first direct purchases by South Korean players in Slovakia and Hungary.

Hyon Suk Jan, Executive Managing Director, JR AMC, Korea, comments: “With yields in Western Europe breaking historic records, the CEE has become a very appealing substitute whereby high yields can still be achieved, simultaneously minimizing any trade-off in building quality or macro risk profile. At the same time, core CEE cities such as Warsaw, Budapest and Prague are strongly growing to become serious competition to traditional Western European cities. Our investment strategy in the short-run in the CEE region is to expand our acquisition of core office properties in well established sub-markets”.

The Chinese belt-and-road initiative

The Chinese belt-and-road initiative has had clear beneficial effects for CEE, with major Chinese institutional investors kicking the tires on prime opportunities. The same economic factors that have stimulated South Korean and other Asian investors are in play with the Chinese, but there is a distinct political overtone as well.

That is both good and bad, as can be seen from some of the most recent developments with Chinese investment overtures in CEE, with Chinese investors moving into a “wait-and-see” mode, as the US/China trade war starts to resonate at the highest levels of the Chinese government.

Japanese institutions still waiting

Contrary to the flow of South Korean, Chinese and Singaporean capital into CEE and Europe, Japanese institutions have so far been slow making outbound investments. This may change over time, but it is expected that they will play things safe and focus on indirect investments, with initial targets being US core open-ended funds.

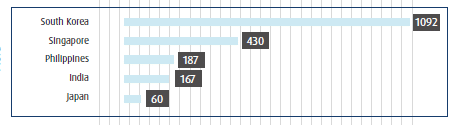

Investors’ origin from Asia in the real estate market in CEE, EUR million (H1 2019):

Structures of the Asian investment

Asian investment is primarily entering CEE through Luxembourg and Netherlands structures. This is a combination of trust in well-trod pathways and tax efficiency. How will it evolve in the future? EU holding structures, in addition to offering business advantages, make possible the repatriation of profits through dividends or interest in an efficient manner. Under the EU Tax Directives dividends, interest payments and royalty payments made to EU companies may benefit from tax exemptions under certain circumstances.

Recently, we have noted increased interest in more direct structures where Asian investors acquire shares in property companies directly from Asia. Such structures may also be quite efficient, depending on the investor and diligent planning.

David Dixon, a Partner of Dentons in Warsaw with a focus on cross-border real estate transactions, noted: “In the last year Asian investors have really made their presence known in CEE, particularly the South Koreans. Singaporean capital is also strongly represented and, while the Chinese have paused a bit as they digest the ramifications of the trade war with the US, the long-term Chinese belt-and-road policy initiative bodes well for their future investment. Favourable exchange rate considerations and higher yields in CEE, coupled with the availability of first-class office buildings and logistics developments should continue to stimulate Asian investment in the coming months.”