- The time of opportunity has arrived in Central and Eastern Europe. It seems that the region hit its lowest point in the third quarter – the worst is behind us, although the recovery in 2024 is likely to be mild. In 2023, we expect the region’s annual growth to be around +0.5% (after +4.0% in 2022) and +2.1% in 2024.

- The elimination of imbalances in the current account reduces vulnerability to systemic shocks that can affect financial flows.

- However, attention should be paid to Romania – the risk of a balance of payments crisis in the event of a reversal of portfolio investment inflows in case of a systemic shock.

- Meanwhile, lower inflation and declining interest rates in Central and Eastern Europe should support the revival of domestic demand in the coming quarters. However, strong wage growth poses a moderate risk of inflation, particularly in Hungary, Slovakia, and Bulgaria.

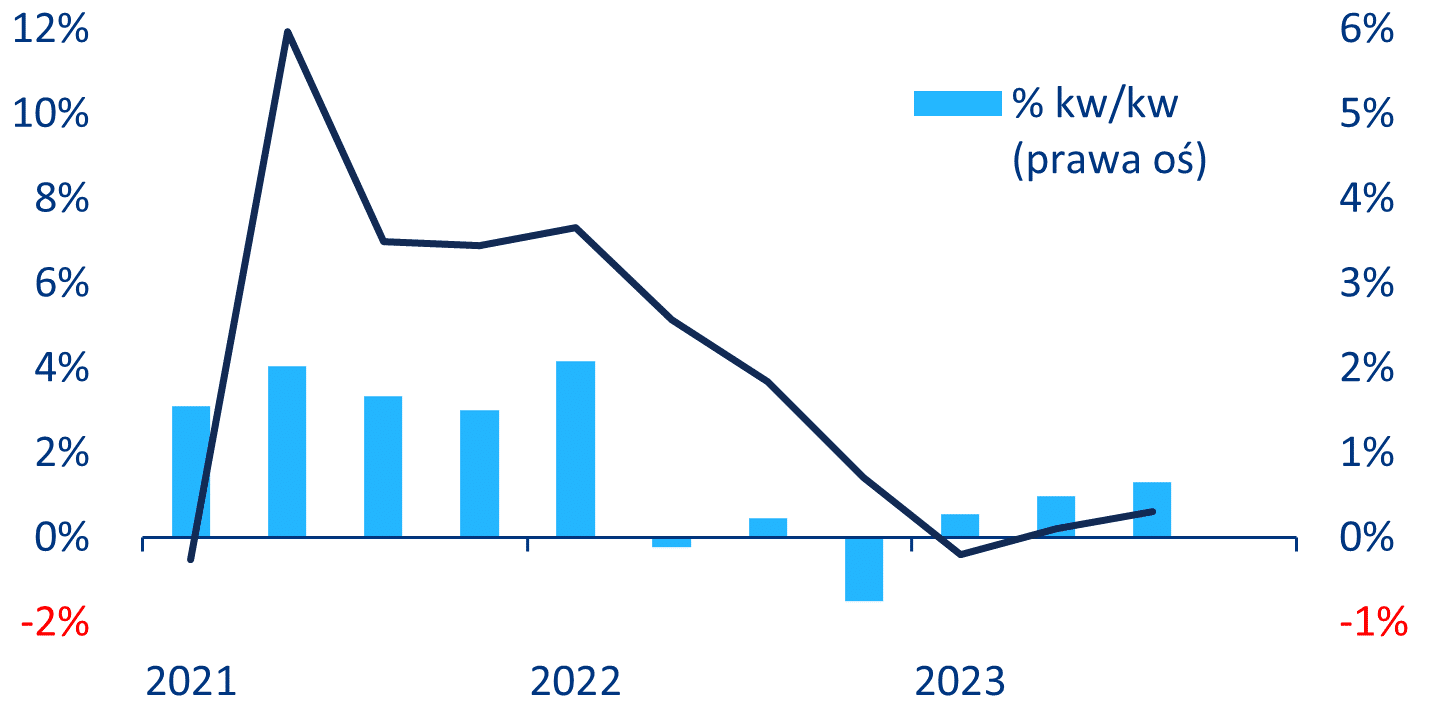

It seems that the bottom of GDP growth in Central and Eastern Europe (CEE) is behind us, although the recovery in 2024 is likely to be mild. Preliminary estimates of real GDP growth in the third quarter showed mixed results in individual economies, but it seems that the worst for the entire region is over. The weighted average real GDP growth of the 11 EU member states in the region (CEE-EU-11) improved to +0.6% quarter-on-quarter in the third quarter from +0.5% in the second quarter and +0.3% in the first quarter of 2023. Seasonally adjusted year-on-year regional growth strengthened to +0.6% in the third quarter after +0.2% in the second quarter and -0.4% in the first quarter (chart below). Monthly data on activity suggest that retail sales and industrial production have also passed their lows in much of the region. Overall, we expect the continuation of a gradual upward GDP trend and Allianz Trade forecasts annual regional growth of around +0.5% in 2023 (after +4.0% in 2022) and +2.1% in 2024. Although the risk of deterioration should not be underestimated, several factors support our (positive) forecasts.

Quarterly real GDP growth for 11 EU member states from Central and Eastern Europe

Sources: National Statistics, Refinitiv Datastream, Allianz Research.

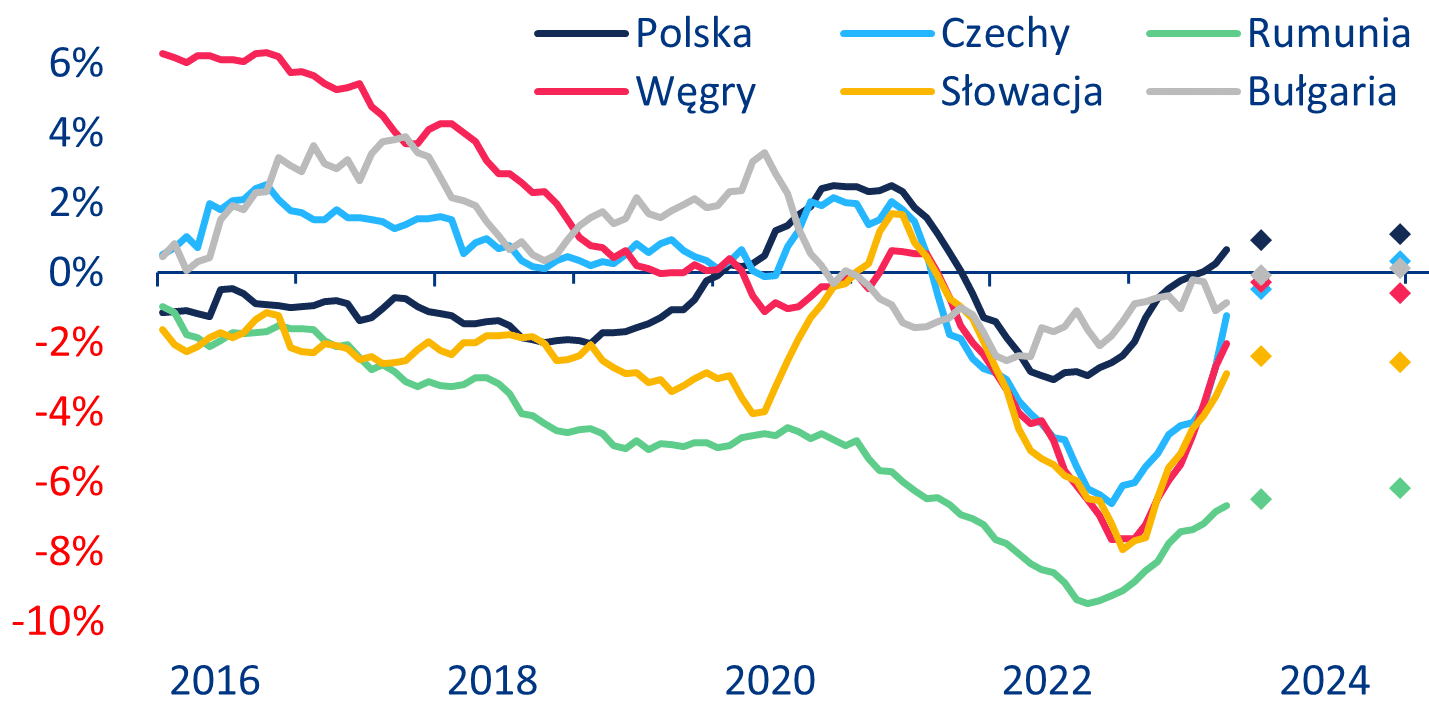

The elimination of imbalances in the current account will reduce vulnerability to systemic shocks affecting financial flows. All EU member state economies in the Central and Eastern European region, particularly the Czech Republic, Romania, Hungary, and Slovakia, experienced growing current account deficits in 2022 due to rising energy and food prices, for which the region is a net importer. However, in 2023, external shortfalls rapidly diminished in much of the region, mainly due to lower energy import prices (carriers) and a decline in import volume due to economic slowdown, and partly due to the governments of these countries starting to implement energy transition plans[1]. For most Central and Eastern European economies, Allianz Trade forecasts moderate annual deficits or even surpluses on the current account for 2023-2024. A noteworthy exception is Romania, where large external financial inflows and high government deficits will likely maintain the external deficit above -6% of GDP over the next two years (chart below). Romania’s current account deficit began to grow a year before the global rise in energy prices, but since then it has been largely covered by net foreign direct investment (FDI) and portfolio investment inflows. The country’s foreign currency reserves have actually increased since the end of 2020. However, the inflow of net FDI recently covers only about one-third of the external deficit. This creates a risk of a balance of payments crisis in Romania in the event of a systemic shock that would reverse the inflow of portfolio investments, which are typically short-term in nature.

Current account balance (% GDP, rolling 12 months)

Sources: Refinitiv Datastream, Allianz Research. Note: Dots represent Allianz Research forecasts at year-end.

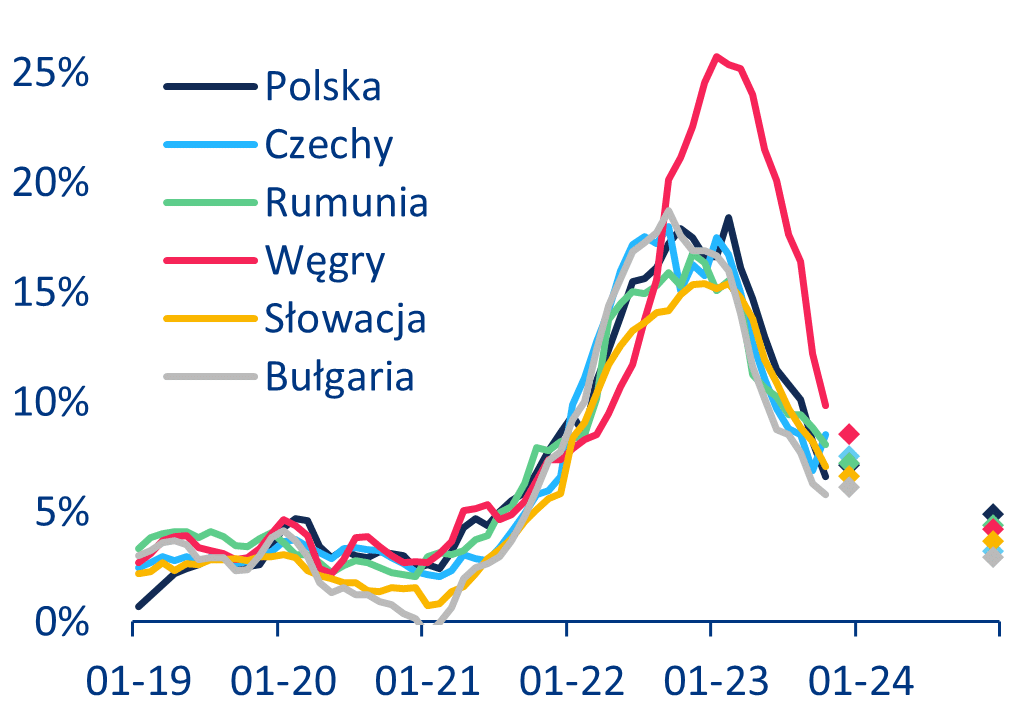

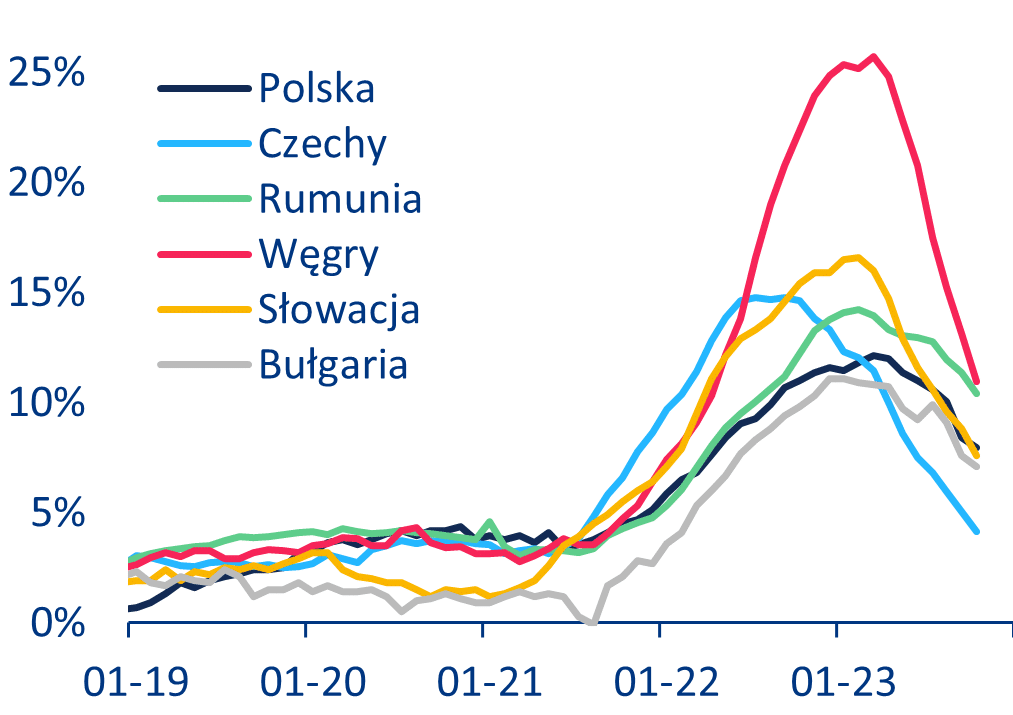

Lower inflation and falling interest rates should support the revival of domestic demand in Central and Eastern Europe in the coming quarters. After peaking at the end of 2022 or early 2023 in Central and Eastern European and EU-11 countries, headline consumer price inflation sharply declined in 2023 (chart below, left). And as core inflation also fell, albeit with a slight delay (chart below, right), we expect further disinflation in 2024. In October 2023, the downward trend in core inflation temporarily ended in the Czech Republic and Estonia. Although this was entirely due to base effects resulting from the introduction of energy price subsidies last year, it indicates that the pace of disinflation is likely to significantly slow down in the coming months across the region, as similar measures also expire in other countries. Overall, Allianz Trade forecasts that core inflation will remain above central bank targets in 2024. Nonetheless, the central banks of Poland and Hungary began a cycle of monetary policy easing in September and October 2023, respectively, in response to falling inflation. The central banks of the Czech Republic and Romania remained more hawkish, and their comments suggest that interest rates may be maintained at an unchanged level until a more significant decline in inflation. We expect that at some point in the first half of 2024, these banks will change their stance. By the end of next year, all central banks in the region are expected to lower interest rates to a range of 4.00% to 5.00%, which should support a mild revival of consumer and capital spending.

Consumer price inflation (% y/y)

Core inflation (% y/y)

Sources: Eurostat, Refinitiv Datastream, Allianz Research. Note: Dots represent Allianz Research forecasts at year-end.

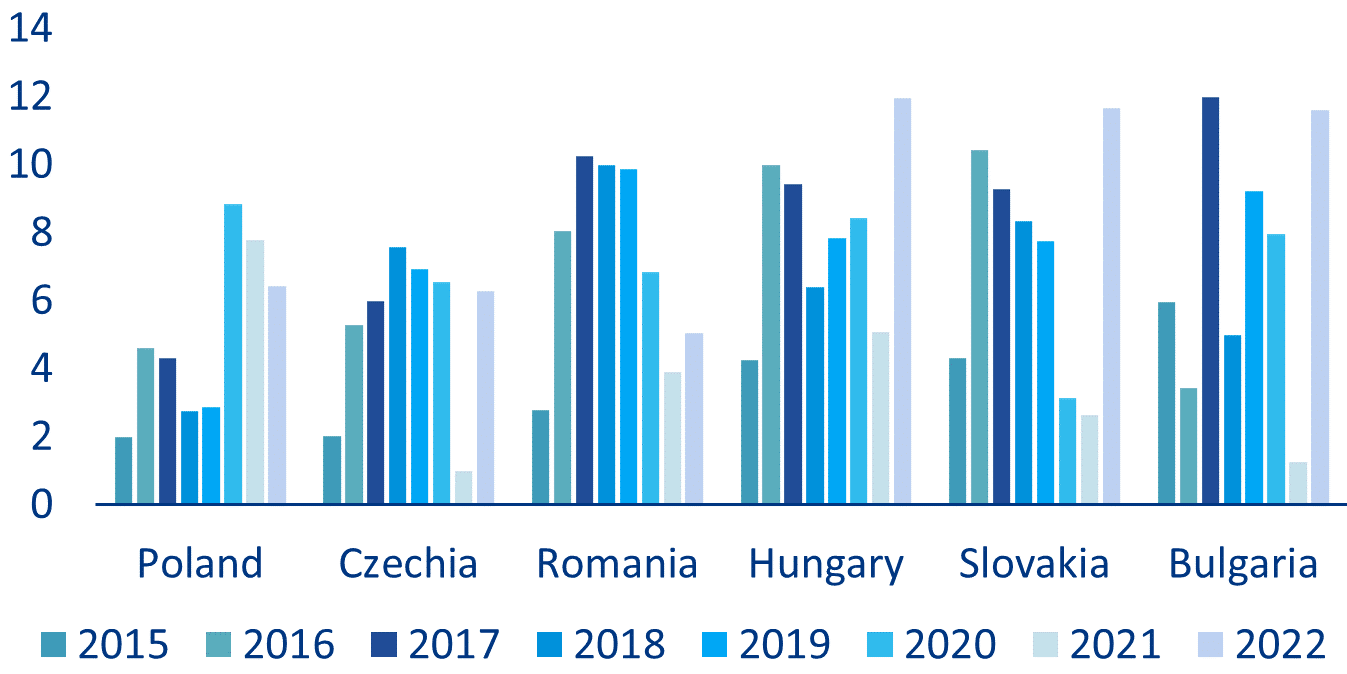

Strong wage growth in Central and Eastern Europe poses a moderate risk of inflation, especially in Hungary, Slovakia, and Bulgaria. As workers and trade unions effectively fought for significant wage increases in the face of rising inflation, nominal wage growth in Central and Eastern European countries significantly increased in 2022-2023. With the exception of the Czech Republic, it was double-digit across the region in the third quarter of 2023. And as consumer price inflation fell, real wage growth returned to positive territory in the meantime. On one hand, this provides further support for consumer spending and thus economic growth. On the other hand, if strong wage growth significantly outpaces productivity growth, it carries the risk of creating a wage-price spiral, which could disrupt the disinflation process. The chart below shows the annual differences between average nominal wage growth and productivity growth in the six main economies of Central and Eastern Europe over the past eight years. In 2022, this difference (between wage growth and productivity growth) clearly increased compared to 2021, except in Poland. However, the difference in 2022 was not much higher in the case of the Czech Republic and even lower in the case of Romania compared to the average of the previous seven years, during which they did not trigger inflation. As a result, it can be concluded that the risk of a wage-price spiral is relatively low in Poland, the Czech Republic, and Romania. The situation is somewhat different in Hungary, Slovakia, and Bulgaria, where the differences between nominal wage growth and productivity growth reached record or near-record levels of close to 12 percentage points in 2022. In this case, policymakers should particularly take care of normalizing wage growth in the coming years to align it with lower inflation and productivity growth, otherwise the emergence of a wage-price spiral cannot be ruled out.

Difference Between Nominal Wage and Productivity Growth (pp)

Sources: Eurostat, Allianz Research

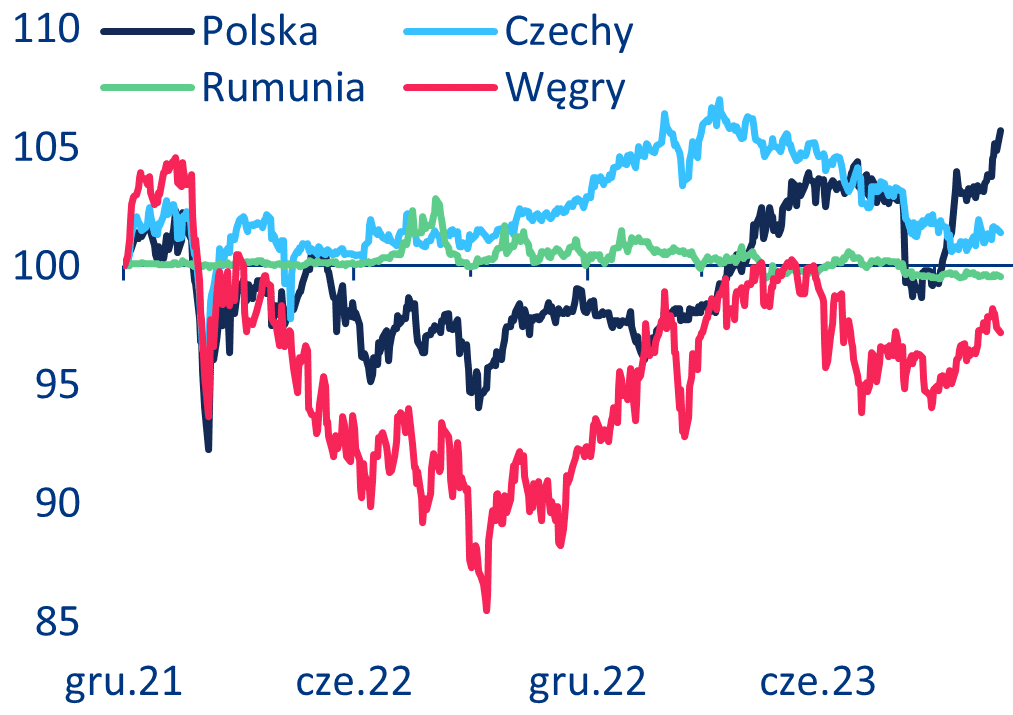

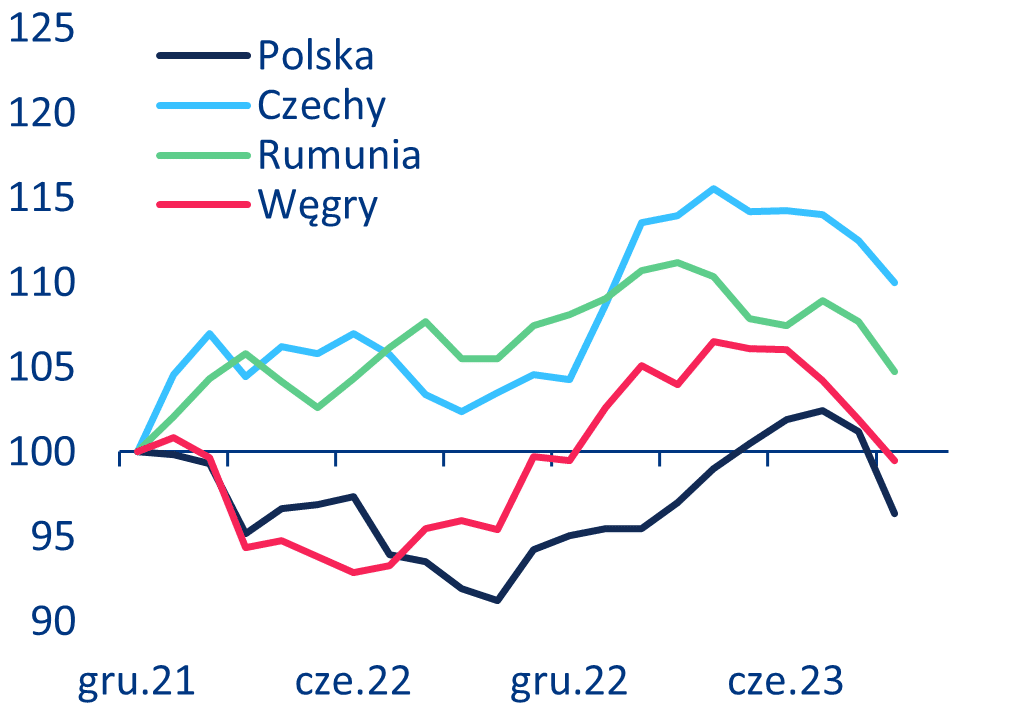

The currency risk in 2024 in most Central and Eastern European countries will be moderate, although there is a potential risk of inflation increase in Romania if the currently strong portfolio inflows are disrupted by a systemic shock. The currencies of Central and Eastern Europe in 2023 were volatile but generally fared relatively well. Notably, the Polish złoty (PLN) and Hungarian forint (HUF) strengthened this year against the euro (EUR). The Czech koruna (CZK) also gained against the euro in the first half of 2023 but lost these gains in the second half of the year. Meanwhile, the Romanian leu (RON) was maintained at a stable level against the euro thanks to ongoing currency interventions when needed (chart below, on the left). A look at the changes in real effective exchange rates based on Producer Price Index (PPI) indicators since the end of 2021 (i.e., covering the slowdown period) indicates that the złoty and forint are not currently overvalued (chart below on the right). This could have supported the central banks of Poland and Hungary in their recent decisions to start easing monetary policy. In contrast, CZK and RON seem to be slightly overvalued at the moment. For the Czech Republic, however, we do not expect a sharp or destructive depreciation of the currency, given the expected shift to a current account surplus in 2024, as well as sufficient foreign exchange reserves (covering about 130% of maturing short-term external debt), which would allow the central bank to defend CZK if necessary. Romania’s position is somewhat weaker. The current account deficit is expected to remain high in 2024 and is largely covered only by short-term portfolio inflows, while foreign exchange reserves cover less than 90% of maturing short-term external debt. In the absence of a systemic (external) shock, this should not be a problem, and the Romanian central bank should be able to maintain the leu (RON) at a stable level. However, if such a shock occurs and leads to capital outflow from Romania, the RON may come under pressure, and inflation may rise again. Economic policy in Romania should focus more on reducing this sensitivity, for example, through targeted fiscal consolidation.

Currency Exchange Rate Changes Relative to EUR

Real Effective Exchange Rate Based on PPI

Sources: LSEG Datastream, Allianz Research.

[1] See also “In Poland and Central and Eastern Europe, an energy crisis is unlikely as of July 14th this year.”