We expect the Federal Reserve to adopt a cautious tone during its meeting on Wednesday (13.12) and defer the market valuations of US interest rate cuts in 2024. Hawkish signals from the bank could provide support for the dollar in the second half of the week.

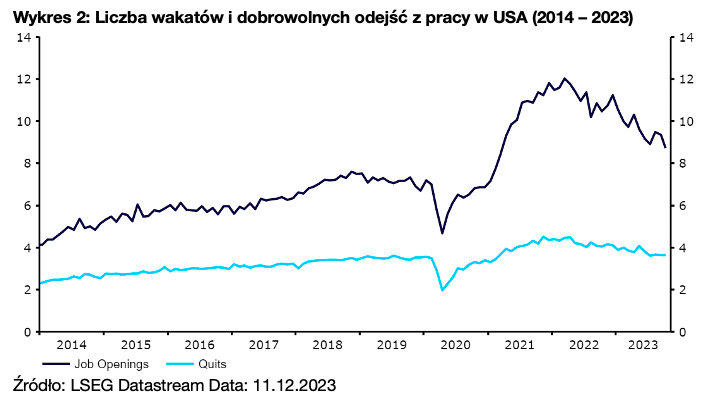

The market expectations regarding the path of the Fed’s interest rates have significantly changed since the last FOMC statement in November, due to the continued decline in inflation in the US and preliminary signs of cooling in the labor market. In futures contracts, the first reduction is now priced in for May (previously July), and the sum of cuts by the end of 2024 is at 110 basis points (compared to 65 basis points). The recent messages from FOMC Chairman Jerome Powell, however, have remained somewhat hawkish and it seems that market valuations and Fed rhetoric are quite distant from each other. Someone will have to give in.

Chart 1: Change in US interest rates by the end of 2024 [bp.]

During his last speech before the quiet period before the meeting, Powell not only pushed back speculation about the possibility of loosening monetary policy in the near future but also did not rule out additional interest rate hikes. According to him, it is “too early” to say that the Fed has raised interest rates to a level sufficient to defeat inflation. Powell believes that the time has not yet come to consider when the policy easing process will begin, which the bank wants to approach “cautiously”. The markets have almost entirely ignored this, and futures contracts place expectations for the Fed’s interest rate cuts in 2024 at a very high level.

In our opinion, the aforementioned market valuations are too aggressive and investors’ enthusiasm excessive. We base this view on three main elements:

- The US labor market remains tight and so far only shows minor signs of cooling. FOMC members will undoubtedly be emboldened by the recent worsening of the labor market situation, but there is no sign of it continuing. Employment growth remains solid at around 200,000, the number of vacancies is significantly above pre-pandemic levels, employment reduction has declined, and there are still few new unemployed claims – their four-week moving average is at about 220,000

Chart 2: Number of vacancies and voluntary departures in the US (2014 – 2023)

- Consumer spending remains at a very good level. The Federal Reserve’s tightening cycle is not yet fully reflected in macroeconomic data because of the US economy’s low sensitivity to high interest rates and a significant lag in policy transmission. Spending remains high and will need to show much clearer signs of slowing down for the Fed to be assured of a sustainable drop in inflation to the 2% target.

- Overcoming the home straight in the fight against inflation will take some time – households and businesses are adjusting to the inflationary environment, expecting higher wages and setting higher prices in turn. Labor strikes are still frequent, as are labor shortages, which should support wage growth and keep inflation at a raised level.

Taking into account the above, we expect the Fed to send hawkish – compared to market expectations – messages on Wednesday. Powell will probably highlight patience and again say that it’s too early to declare victory in the fight against inflation, as well as paying attention to the fact that a period of growth below trend and cooling in the labor market are necessary for the bank to be sure of achieving the set inflation target. He will probably also say that further tightening of monetary policy is possible if progress in the fight against inflation is threatened – markets will however likely take this as a qualifier on the margin, not a form of forward guidance.

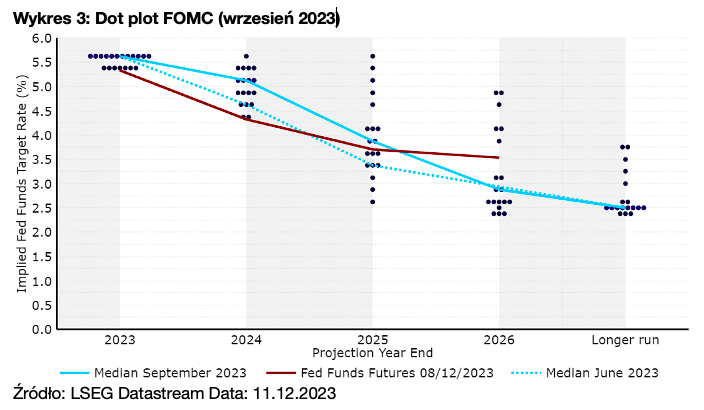

The most important aspect of the Fed’s communication this week will be, in our opinion, its dot plot, i.e. expectations regarding the path of interest rates. In September, when it was last published, projections for the following years were revised upwards. The medians for 2024 and 2025 rose to 5.1% and 3.9% respectively, suggesting only slight policy easing over the next 12 months (currently, rates are in the 5.25–5.50% range).

We suspect that market participants expect a significant revision of these expectations downwards, to align with futures contract valuations. However, we are not sure if the Fed will meet these expectations, and the potential drop in the 2024 median might be relatively small.

Chart 3: FOMC dot plot (September 2023)

Given all of this, we expect the dollar to have a chance to strengthen. The Federal Reserve is not likely to want to expose itself too much and will refrain from actions that could strongly affect sentiments at its last meeting this year. Powell will likely not significantly change the rhetoric presented at the beginning of December, emphasizing that policy easing is not yet on the horizon. His hawkish messages and the dot plot, showing at most a slight downward revision compared to September, could give the dollar some impulse to grow in the second half of the week. Such a turn of events could negatively affect the Polish currency as well.

The FOMC policy decision will be announced on Wednesday (13.12) at 20:00, and Chairman Powell’s press conference will begin 30 minutes later.

Author: Matthew Ryan, CFA – Ebury analyst

![Will the Fed cool market expectations on the pace of interest rate cuts? 1. Wyceniana zmiana stóp procentowych w USA do końca 2024 r. [pb.]](http://ceo.com.pl/en/wp-content/uploads/2023/12/1.-Wyceniana-zmiana-stop-procentowych-w-USA-do-konca-2024-r.-pb.png)