CEE Investment volumes for the Q1-Q3 period have reached ca. €8.0 billion and are 12% down compared to the same period of 2019.

Despite COVID-19 impacts on markets, flow volumes remain relatively healthy for the first 3 quarters of 2020 at ca. €8.0 billion. Poland attracted EUR 4 billion which represents 50% of all volumes in this period according to “The CEE Investment Scene Q1-Q3 2020” report released by Colliers International.

“The Polish investment market has remained strong through the lockdown and the ongoing pandemic. Whilst the end of year volumes are expected to be lower this year, the first 3 quarters delivered ca. EUR 4 bn in closed deals, including EUR 1.5 bn of office and EUR 1.9 bn of logistics, which is on course to establish a new record. We expect continued interest in particular in office and logistics asset classes underpinned by an strong inflow of capital into Poland’s key markets, however transactions understandably will continue to take longer to complete”, says Piotr Mirowski, senior partner, head of Investment Services at Colliers International.

Little movement in prime yields

Since Q2 we have recorded very little movement in prime yields, primarily due to the lack of transactional evidence to support further shifts. Our view remains that while some shifts are inevitable, core, well performing assets should hold up well, with more pressure expected on secondary product. Due to the shift in interest of investors to logistics we can also expect to see prices react accordingly.

Domination of the office sector

The office sector again dominated in the first 3 quarters of 2020. Understandably, Retail and Hotels are down considerably on last year, with logistics significantly up and greater volumes held back only by the shortage of supply.

Western European funds and the CEE domestic investors in acquisition mode

Western European funds have been most active during the first 9 months of 2020, although volumes were supported by Sweden’s Heimstaden Investing into a €1.3 billion residential portfolio in the Czech Republic.

CEE domestic investors, consisting of mainly Czech and Hungarian capital, have also remained in acquisition mode, investing both in their own markets and cross border within CEE. Capital from Asia, particularly Singaporean and South Korean, have continued to secure opportunities in the region.

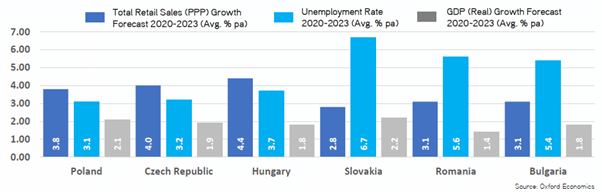

Economies to rebound in 2021

Globally and in CEE, economies are expected to take a hit in 2020, but rebound rapidly from 2021 onwards. Unemployment rates are also expected to increase, and the combination will put downward pressure on retail sales.