The fact that the PMR Construction Confidence Index for the construction chemicals industry remains in solid territory and the lack of signs of a considerable slowdown in residential construction both suggest that 2017 will be yet another excellent year for the leading construction chemical manufacturers. However, the market environment is becoming increasingly difficult for new brands wishing to secure a foothold in the industry.

Data gathered from a survey of several hundred renovation and construction companies held for the needs of the report “Construction chemicals market in Poland 2017 – Development forecasts for 2017-2022” suggests that the construction chemicals sector in Poland is becoming increasingly dominated by a few leading manufacturers despite fast-paced growth of residential construction and a positive market environment.

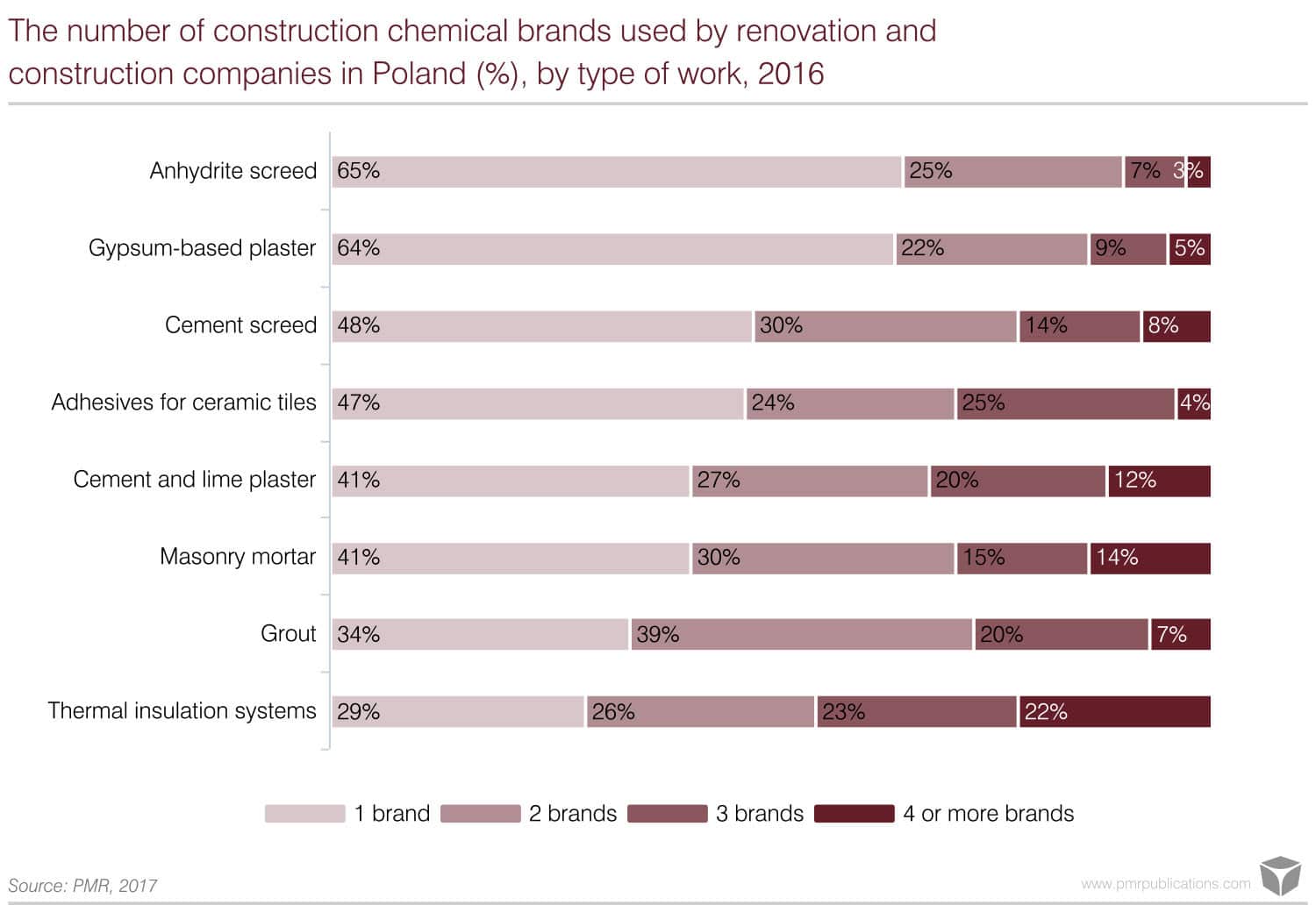

Contractors’ sticking to a tested brand is the most striking trend in the segments of gypsum-based plaster (dominated by Knauf) and anhydrite screed (Atlas and Mapei being the most commonly-used brands) where as much as two-thirds of contractors admitted to using one tried-and-tested brand.

Contractors’ strong attachment to a single brand (at nearly 50%) can also be seen in the segment of cement screed. Companies loyal to a single brand would choose Mapei or Atlas products. Loyalty to a single brand is slightly more common among companies performing projects for individual customers.

Likewise, in the case of tile adhesives, almost half of the contractors only use products from a single, proven manufacturer. Contractors loyal to just one brand usually choose Mapei products and, less frequently, Atlas. Interestingly, it was revealed in the latest edition of the survey that all the leading brands recorded lower numbers of indications when compared to last year’s survey, which was due to reduced diversification of brands among the contractors.

Loyalty to a single brand was reported to be lower in the case of cement and lime plaster and masonry mortar, where four out of every ten companies would use products from a single brand. Atlas mortars were the most popular masonry mortar products. Greater brand diversification was reported for cement and lime plaster. As a result, contractors loyal to a single brand would most frequently use products from Ceresit, Atlas, Knauf or Kreisel.

Among the surveyed product categories, the segment of thermal insulation systems was characterised by the greatest product diversification – contractors’ dedication to use products of a single brand is relatively infrequent (29% of responses). Importantly, companies involved in the execution of orders from institutional customers admitted to using products from a larger number of producers – almost half of the companies used products of at least three thermal insulation brands in 2016.

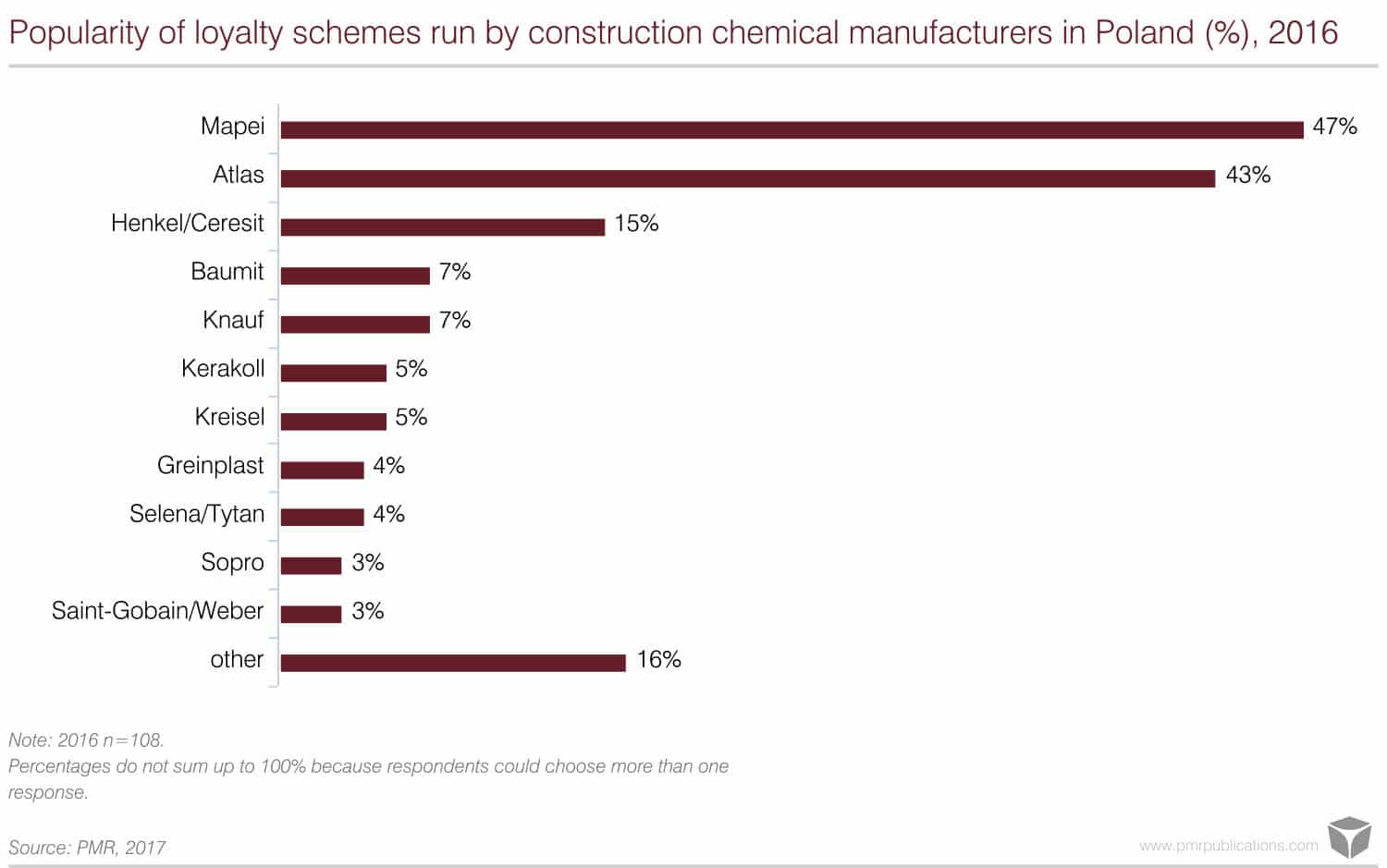

One of the key reasons behind the growing brand loyalty on the part of the contractors are loyalty schemes run by the main producers. One out of every three renovation and construction companies revealed they participated in loyalty schemes. Companies employing from six to nine workers were the most willing to take part in partnership programmes. Mapei and Atlas had the most popular loyalty schemes.

Author of the report: Bartłomiej Sosna