Polish volumes were the drivers of the momentum in the first half of the year. Slovakia saw a rebound in deals whilst Hungary and Czechia saw much slower flow than a year ago, reveals Colliers International, the global industry-leading real estate services company, in its latest 2018 mid-year CEE Investment Scene.

Investment flows into the CEE-6 region rose 4% yoy in H1 2018, marginally exceeding the pace of 2017’s record year.

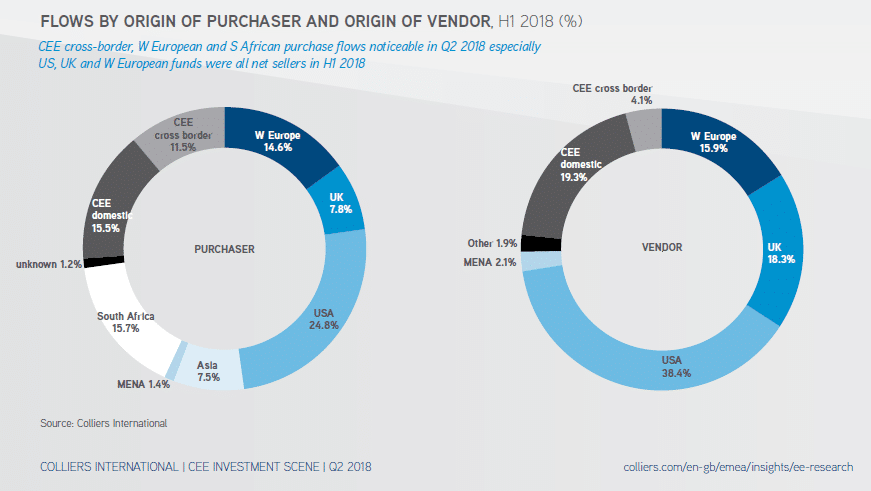

A combined 26% of the money in H1 came from domestic sources within the CEE-6 countries or CEE cross-border flows. US, UK and Western European funds were all net sellers of CEE commercial real estate in the period, broadly repeating the pattern observed in 2016 and 2017.

Polish volumes (58% of the CEE-6 total) were the drivers of the momentum in the first half of the year, on the back of a continued strong performance from the economy. Slovakia saw a rebound in deals this year whilst Hungary and Czechia saw much slower flow than a year ago. A relative lack of supply of product for sale appears to be a factor in these latter two markets.

On the sector front, office (up 51%) nearly caught up with retail (almost flat year-on-year) flow; the expected stimulus from more development completions at this stage of the cycle appears to be occurring.

Mark Robinson, CEE Research Specialist, adds: “The yield compression we have observed in 2016-17 slowed markedly in the first half of 2018, with just a narrowing of prime office yields in Prague and Warsaw to note. We expect further compression over the next 12 months in just the Budapest and Bucharest office/industrial sectors. Looking at fundamentals, we foresee 6 increases amongst the 12 key capital city vacancy rates in Office and Industrial that we follow, after several quarters of falling vacancies across the region. Increasing supply appears to be a factor in play. Rental growth dynamics look strongest in the CEE industrial sector and in Budapest”.