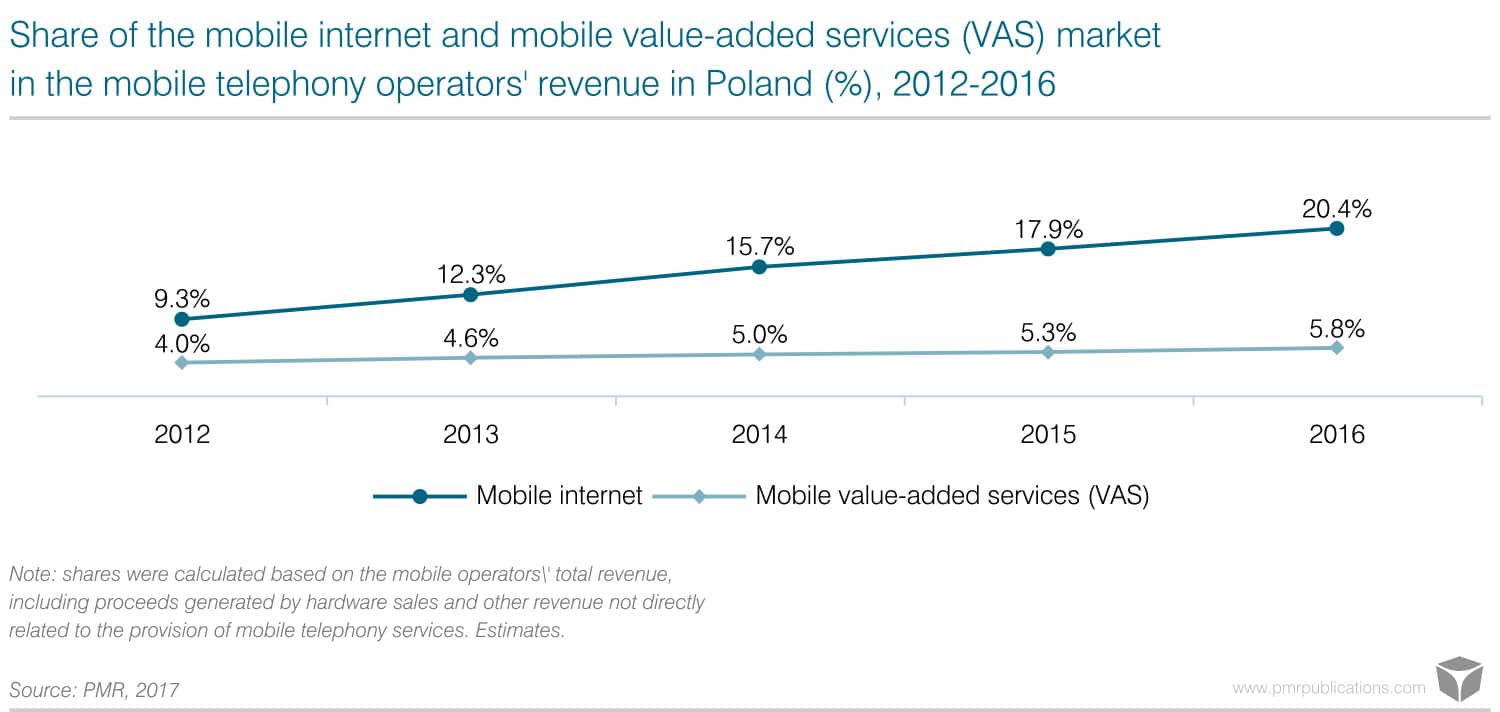

Initial estimates reveal that in 2016 the value of the mobile telephony market as measured with the operators’ revenue reached over PLN 25bn (a 1% year-on-year increase). A fifth of that value was contributed by the telecoms’ proceeds generated in the segment of mobile internet services. This share has been constantly growing as opposed to the segment of mobile value-added services (VAS) where no particular change in this regard has been noticeable in recent years.

According to PMR’s latest report “Mobile internet and value-added services (VAS) market in Poland 2017. Market analysis and development forecasts for 2017-2022”, the estimated value of the Polish mobile internet and mobile value-added services (VAS) market amounted to about PLN 6.6bn in 2016, 14% up on the preceding year. Given the decline in the mobile operators’ revenue generated by traditional services (voice and SMS) this means a radically different environment for the development of the existing solutions and for the introduction of new ones.

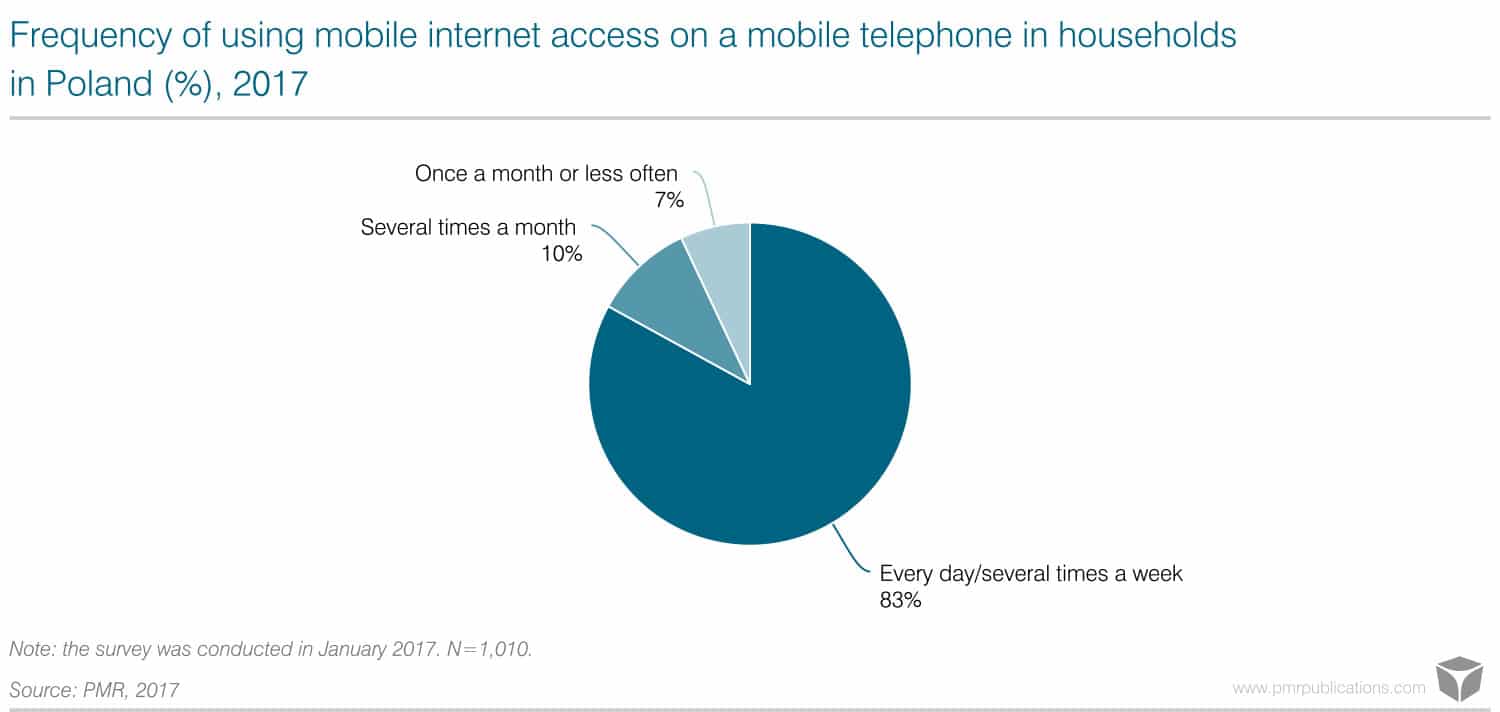

The value of the mobile data-transmission market is influenced by two clear consumer trends. The growth in demand for higher bandwidth has been accompanied by increasing data consumption per user. This is a consequence of the use of audio and video streaming and the greater consumption of other multimedia content, applications, online games or cloud services. Demand translates into higher revenue. It also forces the operators to improve the quality of the services they offer and of their investments, especially as this is one of the key tools for enhancing customer loyalty. Mobile internet access prices in Poland are among the lowest ones in Europe and the operators are not pressed to continue lowering them. With stabilising prices, there has been a rise in the number of users inclined to spend a certain amount of money on the service in order to get a bigger data bundle and higher bandwidth.

In recent years the value of the VAS segment in the Polish mobile networks has been expanding at a relatively steady rate. SMS payment services remain the biggest market segment in terms of value which, despite its continued growth driven by payments for games and applications, has been gradually losing its share, primarily to SMS marketing solutions.

The outlook for the coming years on the mobile internet and value-added services market in Poland remains optimistic. The market value will be expanding continuously, although its growth rate will have to decrease owing to the high base effect. The rise both in the number of users and in the generated revenue plays its role. Nevertheless, in nominal terms the discussed market may grow in value by at least PLN 700m. PMR estimates that despite the organic growth in the revenue contributed by mobile internet access and other value-added services, in the next six years voice solutions and wholesale services will continue to predominate in mobile networks.