BNP Paribas Real Estate unveils its Pan-European footfall analysis, the first-ever study of the pedestrian traffic of the prime streets in 23 key cities

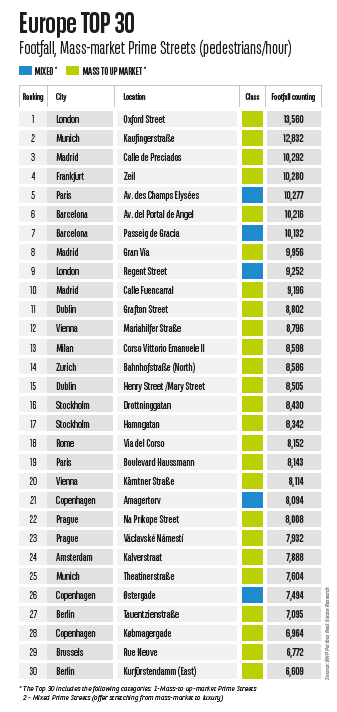

United Kingdom, Germany, Spain and France compete for the top 5 positions in the European Top 30 Mass Market.

- London leads the way with a record value of 13,560 pedestrians per hour in Oxford Street.

- The survey highlights the strength of the main German regional capitals, with Munich and Frankfurt being in the Top 5.

- Notably, Spain with Madrid (3rd) and Barcelona (6th) has a total of five streets in the Top 10.

- France‘s iconic Avenue des Champs Elysées closes the Top 5 with around 10,300 pedestrians per hour.

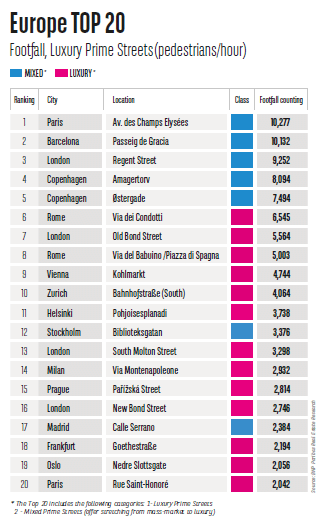

As regards Top 20 luxury high streets, the Top 5 figures are recorded by France, Spain, UK and, a step behind, Denmark.

- These streets are “iconic” walkway precincts which enjoy a high degree of tourist activity.

- Genuine luxury prime streets are dominated by Italy with Rome’s Via Condotti.

Footfall top mass-market high streets

Structure of downtown retail cores

A correlation links the footfall to the spatial structure of city core areas. Where cities present a single retail core, focused on 2 to 3 prime streets, highest numbers are achieved on these streets (Munich, Dublin, the Scandinavian cities, Prague and Zurich for example). Inversely, due to their large catchment areas, London, Berlin and Paris do not have a single core but rather have multiple clusters; hence they achieve a record footfall on their two iconic and most visible streets while more “modest” traffic – nonetheless good performances for retailers – is achieved for the remaining clusters.

Transport hubs and urban regeneration play a key role in heavy generation of footfall figures. Prime streets located near transport hubs -like Oslo and Helsinki- take advantage of the flows from these hubs. Urban regeneration creates not only an improved shopping environment, but also rejuvenates the market supply by attracting new retailers and investors. Warsaw, Vienna and Lisbon have recently experienced such outcomes. New retail schemes develop flows as well, they can even shift the retail focal point as seen in Amsterdam.

Role of tourism

Alongside the major metropolitan areas, a group of smaller cities boast a worthy position in terms of flows. The cities include for example Vienna, Dublin, Zurich and Stockholm which feature in the Top 20 of mass-market prime streets. The local economic and cultural character of these towns has a significant impact on these numbers. However, tourism clearly stands out as a key driver of footfall, all the more so as counting was undertaken in June, when tourism enters the peak periods and sunshine hours are at a maximum in Scandinavia.

Footfall top luxury high streets

In the luxury high street sector, the Top 5 figures are recorded by France, Spain, UK and, a step behind, Denmark. The top five streets are “iconic” walkway precincts which enjoy a high degree of tourist activity.

In the luxury high street sector, the Top 5 figures are recorded by France, Spain, UK and, a step behind, Denmark. The top five streets are “iconic” walkway precincts which enjoy a high degree of tourist activity.In addition, they are not “pure” luxury as their offers cover the entire range from mass-market to luxury; hence the heavy footfall is made up of a full extent of customer profiles both local and visitors. Genuine luxury prime streets are dominated by Italy: Rome’s Via Condotti which leads to Piazza di Spagna is the top luxury spot in terms of footfall.

About the study

Significant differences in the number of passers-by have implications for customer conversion and with it sales-potential. Retail investors rely on this information together with other data and examinations to formulate their expansion strategy and to identify particular locations of interest. This Pan-European Footfall analysis is aimed at providing a one-off “picture” of the prime streets in 23 key global and lifestyle cities. Pedestrian traffic is one of the prime indicators of retail strength, albeit not sufficient in its own right to be a fully determinant driver. The fundamental measure of a successful retail area is the conversion of pedestrian flows into purchases. Indeed, in some areas of lesser footfall such as for example luxury precincts, high store turnovers can occur despite the lower flows.

Methodology

This first-ever study has been co-ordinated by the Research and Leasing teams of BNP Paribas Real Estate across 23 cities throughout Europe. It was activated on Saturday the 10th of June 2017 between the hours of 14:00 and 16:00 or peak hours, taking into account the cultural trading differences of cities. Each city was divided into “Mass-Market to Upmarket” and “Luxury” categories and between 3 and 10 streets were selected, depending on scale and population of the city.

Focus on Warsaw

Marszałkowska Street records the highest footfall due to a strategic location at the crossing of two major avenues in Warsaw. Flows are enhanced by Wars Sawa Junior mass-market department store with brands like TK Maxx, H&M, Zara, Home&You, Carrefour, Mango, Empik and C&A.

Nowy Świat records second-best footfall volumes. This former Royal route, a favourite touristic thoroughfare, leads to the prime Old Town touristic square and takes advantage of direct proximity to the University.

Plac Trzech Krzyży is the most exclusive precinct, close to the Parliament, the Stock Exchange, embassies and consulates. It forms a mix of leisure/catering and luxury retail destination in a prestigious location.