Unlocking funds from the National Recovery Plan will be one of the most critical tasks for the new government. There is very little time left to allocate these resources. The disbursement of approximately 158 billion PLN from the National Recovery Plan was halted for nearly two years due to a dispute over the rule of law, led by the United Right government against the European Commission. These funds are urgently needed in local government budgets, companies, and the entire economy, which is why economists emphasize that resolving the conflict with the EU and releasing the funds will be paramount for the new government, likely known by early December. “Poland still has a chance to unlock these funds and implement the reforms included in the National Recovery Plan,” says Dr. Sławomir Dudek, president of the Institute of Public Finance.

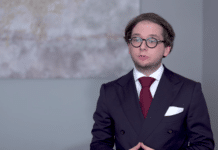

“One of the primary tasks of the new government should be to unlock the funds from the National Recovery Plan because these are funds that would flow to businesses and local governments, providing relief to public finances. The second issue is the reforms contained therein, concerning energy transformation, digitization, courts, and the rule of law. The third matter is credibility; rejecting the NRP is effectively interpreted by the markets as a sign that Poland might leave the EU,” says economist Dr. Sławomir Dudek to the Newseria Business agency.

The topic of NRP funds resurfaced ahead of the October parliamentary elections, as the release of these funds was a key demand of the Civic Coalition. The opposition, including the Civic Coalition, Third Way, and the Left, won 248 seats in the new Sejm and currently has the best chance of forming a new government by early December. As recent reports by Bank Millennium economists suggest, such a scenario would signify warming relations with the EU and a higher likelihood of NRP funds inflow, as well as more efficient absorption of cohesion policy funds. A public finance expert believes that ending the dispute and releasing NRP funds will be vital for Poland’s credibility on the international stage.

“Our membership in the European Union determines foreign investments in Poland, our yields, and the exchange rate of the złoty. Companies from Asia or the USA invest in us precisely because we are in the EU. The lack of NRP results in a loss of this credibility,” says the president of the Institute of Public Finance. “The EU itself may move towards a two-speed system. If we don’t participate in programs like the NRP, we’ll be on the EU’s periphery, with countries like Poland or Hungary no one will want to talk to, as it’s a clear conflict over fundamental values, the rule of law, and money. Other countries will develop and move forward, and we will be left out.”

Investors also see new political orders as an opportunity for Poland, as evidenced by the positive reaction of financial markets to election results, anticipating improved relations between Warsaw and Brussels.

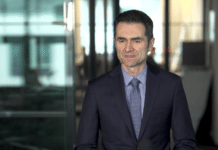

“We are losing due to the conflict with the European Union,” the expert assesses. “We have high yields, higher by 1 percentage point, for example, than in the Czech Republic. The złoty has been breaking records of weakness, and its rate is still volatile – sometimes very weak, sometimes slightly strengthening. These are tangible losses for company budgets. This shows that the dispute around the NRP and the lack of these funds causes real losses in many areas.”