In the financial world, the months of September and October are often considered pivotal. This year, they could potentially determine the trajectory of stock market performances not just in Poland, but across Europe. The general consensus among experts is that if unforeseen events do not disrupt the markets, we can expect an upward trend next year. This is because stock markets typically predict real economic events six to nine months in advance. However, there has been a noticeable lack of response to the current declining economic situation on the continent.

High inflation rates have made the situation further precarious, and it’s noteworthy that stock exchanges are increasingly being overshadowed as capital providers by private investors. Despite these challenges, Central and Eastern European stock markets remain resilient, maintaining their essential role in the economy.

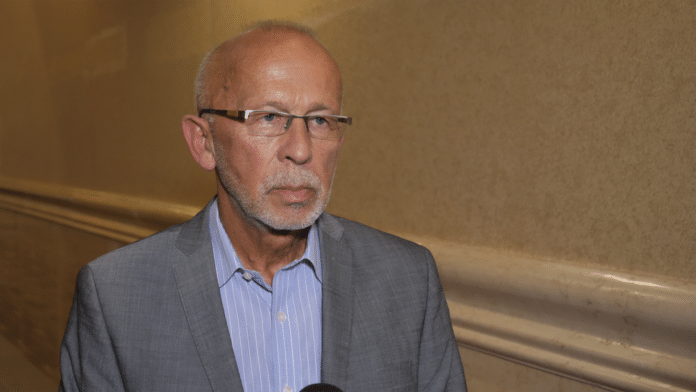

Wiesław Rozłucki, the founder and first chairman of the Warsaw Stock Exchange for 15 years and current strategic advisor to Rothschild & Co., offered his insights. “The sentiment in European markets isn’t the best. Although inflation rates are dropping in Europe and in Poland (despite being double than that of Western Europe), there’s hope that perhaps we’ve seen the worst and better days are on the horizon.”

Between October 2022 and January 2023, and later from March to the end of July, the Warsaw Stock Exchange experienced a favourable period. The main index for large companies, WIG20, reached a peak of 2200 points, a significant leap from less than 1400 points the previous October. However, this upward trajectory was disrupted in August, thanks largely to poor macroeconomic data from Europe’s heavyweight economies, including Germany. Rising interest rates intended to curb inflation are also impacting GDP growth and increasing costs for businesses issuing bonds.

External shocks, like the global pandemic, lockdowns, and the Ukraine conflict, have made profound impacts on the economy, leading to market fluctuations. “The trajectory of our future is contingent on international developments. There are unpredictable events that have a significant bearing on every market. If such events transpire, all prior forecasts become obsolete,” reminds Rozłucki. “Yet, if we assume no major disruptions and the economy develops organically, the coming year seems promising, and the stock market will discount the future.”

High inflation remains a concern for markets, causing uncertainty among investors and companies alike. Economic and monetary policies have a more pronounced effect on the markets than in the past decade. On the upside, the determination of major central banks like the Fed and the ECB to combat rising prices should lead to greater market stability, thereby restoring investor confidence.

Rozłucki also points out a significant trend: stock exchanges are increasingly less involved in providing capital to companies. More often, public offers are focused on allowing founders to exit on the secondary market. Thus, the proceeds from these public offers go to the sellers, not for the company’s development. This trend is visible across most European markets.

In 2023, the Warsaw Stock Exchange’s primary market saw only eight debuts, all transitioning from the alternative NewConnect market. The situation looks somewhat better in secondary emissions, with 57 recorded so far, matching the number around this time in 2022. However, the total emission amount this year is merely 1.5 billion zł, in stark contrast to 7.2 billion zł the previous year.

The key to enhancing the role of stock exchanges lies in attractive offers and companies that share their profits with shareholders. “It might sound simple, but achieving this is quite challenging,” comments the former Warsaw Stock Exchange chairman.

However, this doesn’t spell doom for the Warsaw Stock Exchange or its peers in the region. As Rozłucki emphasizes, none of these stock exchanges was ever large on a European scale. Each has its unique position and prospects in their respective economies. Their primary role, as since their inception, is to mobilize capital for companies in need, enabling investors to profit.

Yet, as the expert stresses, maintaining this role is becoming increasingly difficult due to rising regulatory requirements and operational costs. Reflecting on the history and future plans of the Warsaw Stock Exchange, Rozłucki concludes, “It’s thriving as an institution, continually seeking and integrating newer technologies and data management techniques. While the institution is performing admirably, the market itself is in a slump.”

In conclusion, while challenges loom, the foundational role of stock exchanges in the economic landscape remains unshaken. As market dynamics continue to evolve, their ability to adapt and cater to changing needs will determine their future success.