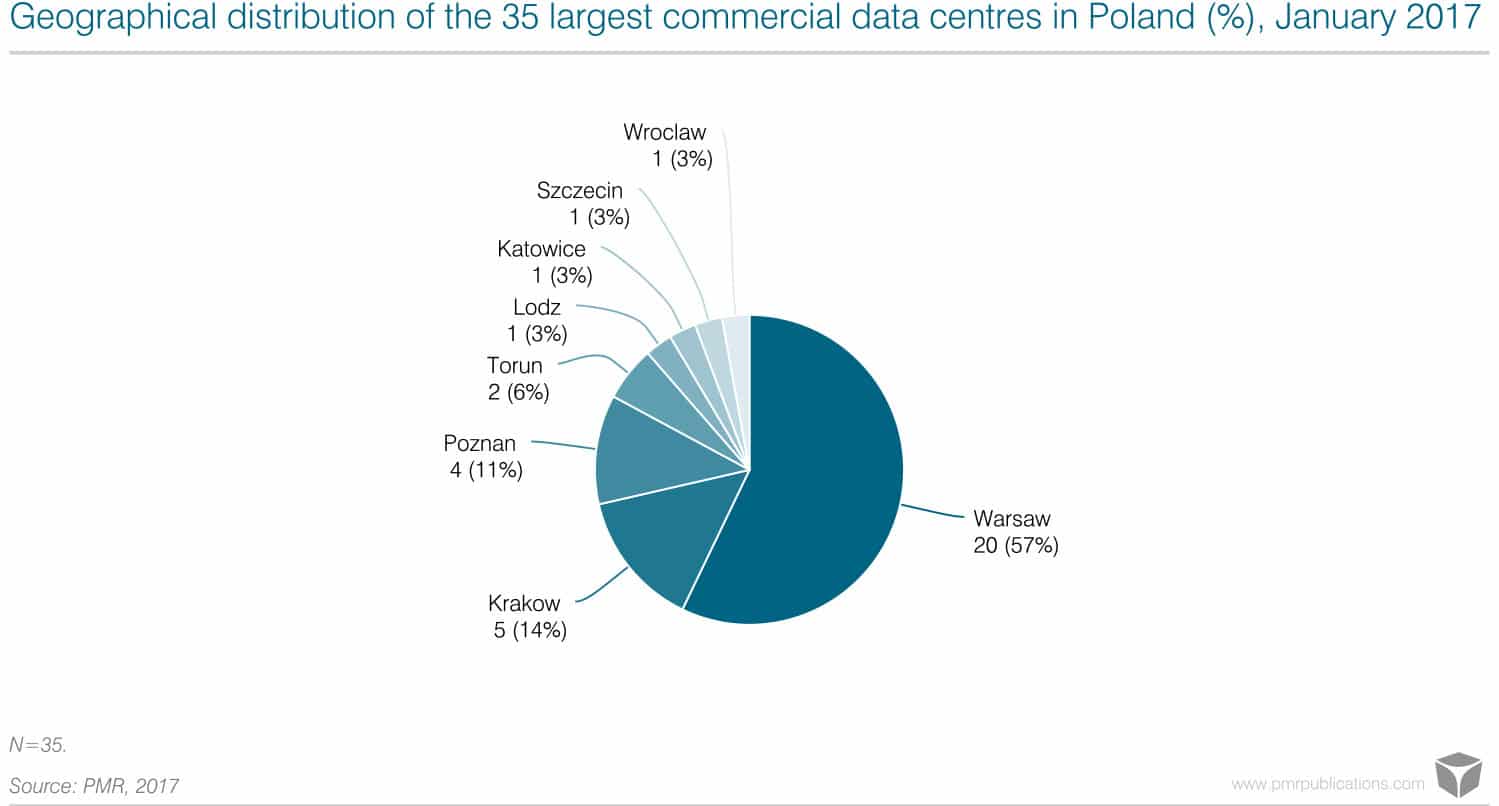

Last year saw the completion of several large investments in the data centre sector in Poland. Another major wave of capacity additions will hit the market at the turn of 2018 and 2019. Warsaw is once again the main hotspot of data centre construction activity.

The Polish data centre services market grew by 12% to PLN 1.45bn in 2016, according to a new report from PMR titled “Data centre market in Poland 2017. Market analysis and development forecasts 2017-2022”. The total square metrage of colocation space increased too. Significantly, data centre space supply grew substantially ahead of demand in 2015-2016, leading to a fall in occupancy rates. Occupancy could pick up in 2017, however, due to fewer projects scheduled for completion.

The Polish data centre services market witnessed important changes and developments in each of the past few years. Here’s our take on the most important events of 2016:

– the acquisition of the market leader ATM by MCI. Private Ventures, an investment fund

– Beyond.pl opening Poland’s first Rated-4 data centre

– Orange expanding its data centre in Lodz with a view to offering commercial services

– Grupa CPS (Plus Data Center) entering the data centre services market

– OVH opening its own data centre in Poland

Also, a number of data centre operators completed new facilities or capacity extensions in 2016, including Artnet, Comarch, Equinix (Poland), Main (EIP), and T-Mobile Polska.

The Polish data centre market is dominated by large facilities, our analysis shows. Data centres measuring 2,500 m2 or more accounted for 54% of the total gross data centre space in Poland in January 2017, and data centres measuring 1,000 m2 or more had a share of almost 75%.

Most providers are trying to build a presence in Warsaw. The latest example is 3S Box, which inaugurated a data centre in the capital on 23 March. The first customers will move there in April.

But it is the project announced in November 2016 by Adgar Poland, an investor, developer, owner and manager of office buildings, that will have the greatest significance for the Polish data centre market. Adgar plans to build a huge data centre in Warsaw’s Mokotow district that will boast 3,880 m2 of server room space spread over 4 storeys (i.e., 970 m2 per storey), and the company has already secured two electrical utility feeds with total capacity of 17 MW (2×8.5 MW) for the facility.

In an interview with PMR, Adgar executives said they expected to fill the centre with customers more quickly thanks to its location. The site lies within Warsaw’s main office district – an area containing approximately 1 million m2 of office space and housing major banks, telecom operators and other large companies.

Once completed, Adgar’s centre will be the second-largest commercial server facility in Poland, only behind ATMAN in Warsaw’s Grochowska street. Yet ATMAN has a different character – it is a collection of data halls that ATM built gradually over nearly a decade.

Significantly, the Adgar centre will beat T-Mobile’s largest facility, located in Piaseczno near Warsaw, in terms of net commercial space – provided, that is, that T-Mobile does not decide to expand the site.

This press release is based on information contained in the latest PMR report entitled: Data centre market in Poland 2017