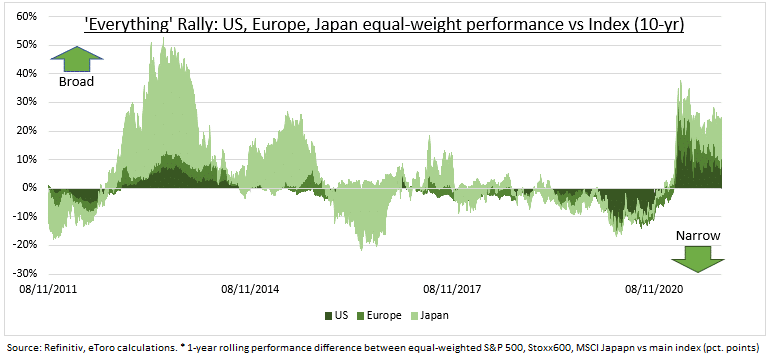

Equities have set new records and are resilient to rising inflation. We are positive on the fundamentals, seeing more profit surprises ahead, and still low bond yields supporting high valuations. History also shows 1, 3 and 12-month S&P 500 returns after new highs all positive. A key support is the market ‘breadth’ this year. The so-called ‘everything’ rally (see chart). This is not just a US phenomenon, but global, and a key change vs the tech-led 2020. This reflects the broad GDP rebound, and has more to go. The vast majority of countries and industries are seeing positive earnings revisions.

BREADTH IS GOOD: Equal-weighted versions of the S&P 500, Europe’s Stoxx 600, and MSCI Japan indices have all outperformed their better-known weighted peers this year. This everything rally breadth is nearer the norm and more sustainable than 2020’s tech-led mega-cap leadership. The mainstream indices are concentrated. Top-ten stocks are 29% the S&P 500 (SPY), 22% of MSCI Japan (EWJ), 18% Europe’ Stoxx600 index.

THE WINNERS: Energy, banks, and real estate have been the best performers this year. Tech has also outperformed, but to a lesser degree than last year. Reopening stocks have bested work-from-home. Small caps have outperformed. 75% of the major global equity markets have seen earnings forecasts raised in the last month, and 95% of US industries.

Ben Laidler, eToro